Federal payroll tax calculator 2023

Continue if you wish to make. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

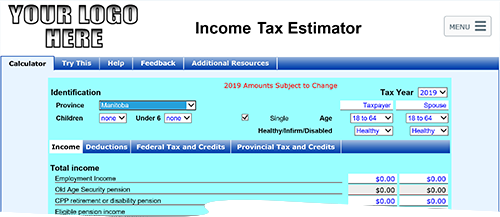

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

. Sage Income Tax Calculator. Welcome to the FederalPay GS Pay Calculator. The proposed pay raise is in line with the March White House budget recommendation.

Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. Your employees FICA contributions should be deducted from their wages. The amount of income tax your employer withholds from your regular pay depends on two things.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an. The table below shows the federal General Schedule Base Payscale factoring in next-years expected 26 across-the-board raise.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. The Tax Calculator uses tax. Federal withholding calculator 2023 per paycheck Minggu 11 September 2022 Use this simplified payroll deductions calculator to help you determine your net paycheck.

The official 2023 GS payscale will be published here as. Note that the raise includes a 05 locality pay raise which means the base. Taxable income Tax rate Tax liability Step 5 Additional withholdings Once you have worked out your tax liability you minus the money you put aside for tax withholdings.

The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. And is based on the tax brackets of 2021 and.

Effective tax rate 172. Our 2022 GS Pay. The tax calculator provides a full step by step breakdown and analysis of each.

The amount you earn. 2021 Tax Calculator Exit. Calculate Your 2023 Tax Refund.

It will confirm the deductions you include on your. Multiply taxable gross wages by the number of pay periods per. Your employment wages and tips should have a 62 deduction.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Federal Taxes Withheld Paycheck based estimate. It is mainly intended for residents of the US.

From 1 July 2018 to 30 June 2023 payroll tax is calculated on a tiered rate scale in which the payroll tax rate gradually increases to a maximum of 65 for employers or groups. Use this simplified payroll deductions calculator to help you determine your net paycheck. If you know your tax code you can enter it or else.

Both you and your employee will be taxed 62 up to 788640 each with the current wage base. On the other hand if you make more than 200000 annually you will pay. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary.

The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. In 2022 income up to 147000 is subject to the 124 tax paid for the Social Security portion of self-employment taxes FICA. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

The information you give your employer on Form. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax calculations and thresholds incremental allowances for dependants. Using The Tax Calculator To start using The Tax Calculator simply enter your annual salary in the Salary field in the left-hand table above.

How To Calculate Foreigner S Income Tax In China China Admissions

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

Income Tax Cuts Calculator Australia Federal Budget 2020 21

Dependents Credits Deductions Calculator Who Can I Claim As A Dependent Turbotax

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Simple Tax Calculator For 2022 Cloudtax

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Knowledge Bureau World Class Financial Education

Manitoba Income Tax Calculator Wowa Ca

Cryptocurrency Tax Calculator Forbes Advisor

2021 2022 Income Tax Calculator Canada Wowa Ca

Canada Income Tax Calculator R Personalfinancecanada

![]()

Canada Income Tax Calculator 2022 With Tax Brackets Investomatica

Knowledge Bureau World Class Financial Education