Expected rate of return formula

In this example the expected return is. You are free to use this image on your website templates etc Please provide us with an attribution link.

Expected Return How To Calculate A Portfolio S Expected Return

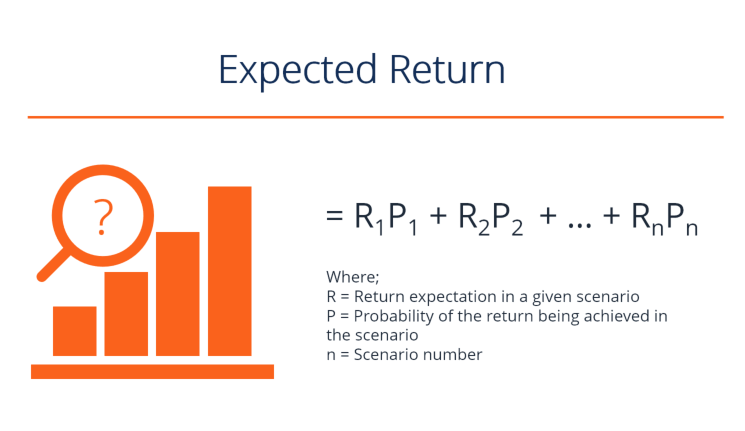

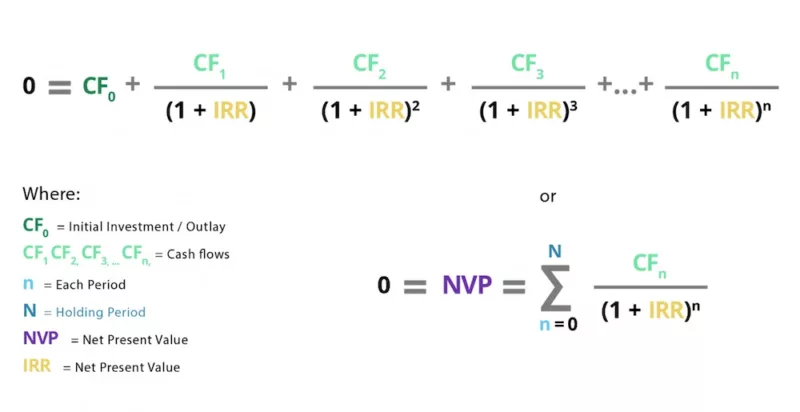

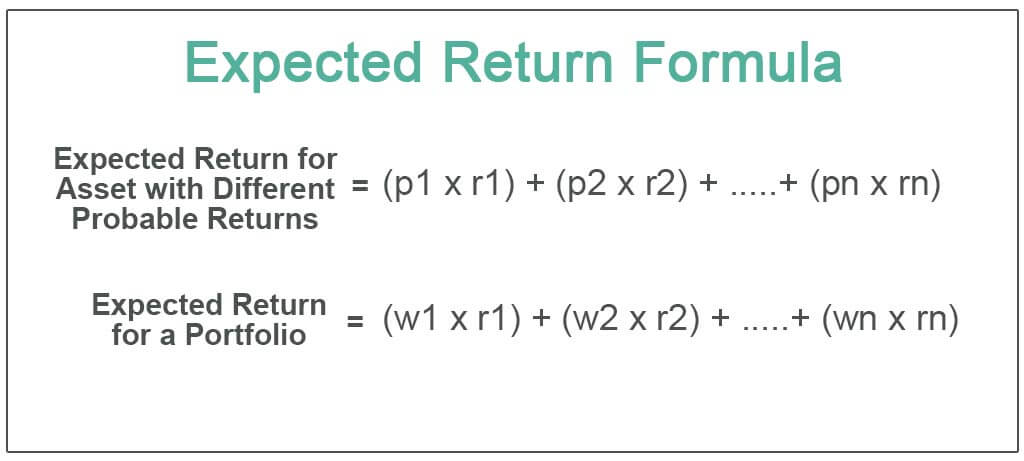

Expected Rate of Return Probability of Outcome x Rate of Outcome Probability of Outcome x Rate of Outcome Use.

. The expected rate of return is the return on investment that an investor anticipates receiving. A rate of return is expressed as a percentage of the investments initial cost. It is calculated by estimating the probability of a full range of returns on.

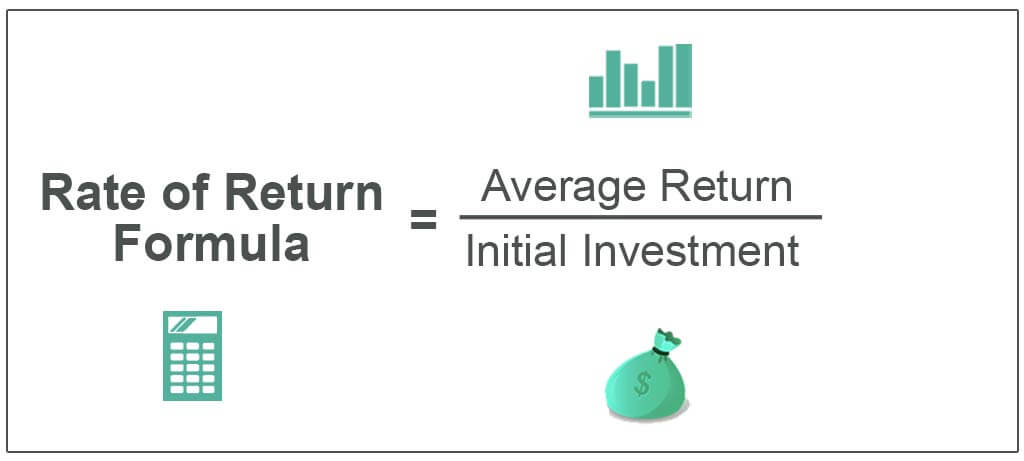

For example an investment that grew from 100 to 110 has a 10 rate of return. The formula to calculate expected rate of return is given by. One just needs to multiply the expected rate of return for each asset.

Expected return of investment portfolio 0210 0215 035 expected return of investment portfolio. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. For example an investment that grew from.

A rate of return is typically expressed as a percentage of the investmentâ s initial cost. Now with the rate of return and asset weight in hand one can calculate the expected rate of return. Expected Return is calculated.

The Expected Return is the profit or loss anticipated by an investor on an investment that has known or anticipated rates of return RoR. 045. How does this stock compare to a high yield savings account that pays 5 in annual interest.

New Look At Your Financial Strategy. You can then plug these values into the formula as follows. Visit The Official Edward Jones Site.

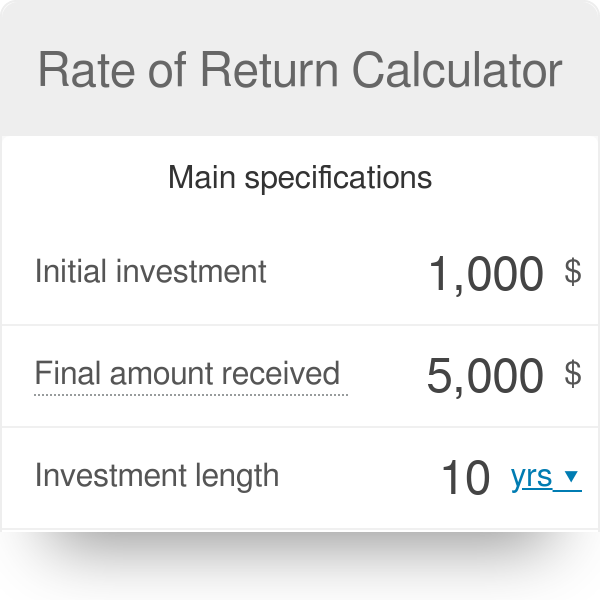

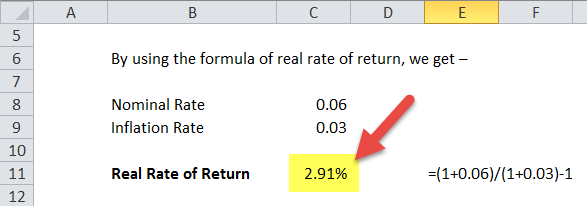

Mathematically it is represented as Average Rate of Return formula Average Annual Net Earnings After Taxes Initial investment 100. Accounting Rate of Return ARR Average Annual Profit Initial Investment. Rate of return Current value Initial value Initial Value 100.

Average Rate of Return formula Average. Finally in cell F2 enter the formula D2E2 D3E3 D4E4 to find the annual expected return of your portfolio. Suppose the expected rate of return on a stock is 30 in year one followed by -25 in year two.

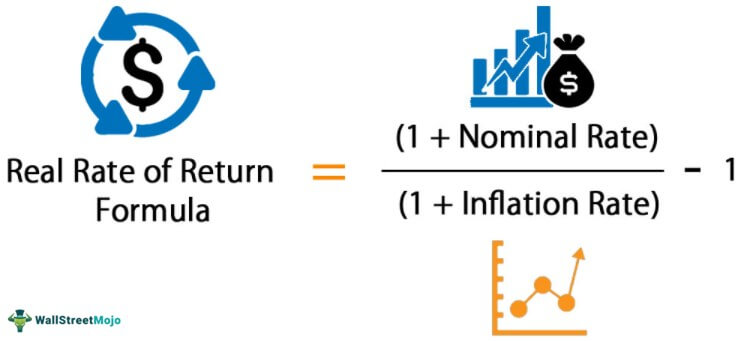

Real Rate Of Return Definition Formula How To Calculate

Rate Of Return Calculator

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Rate Of Return Formula Calculator Excel Template

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

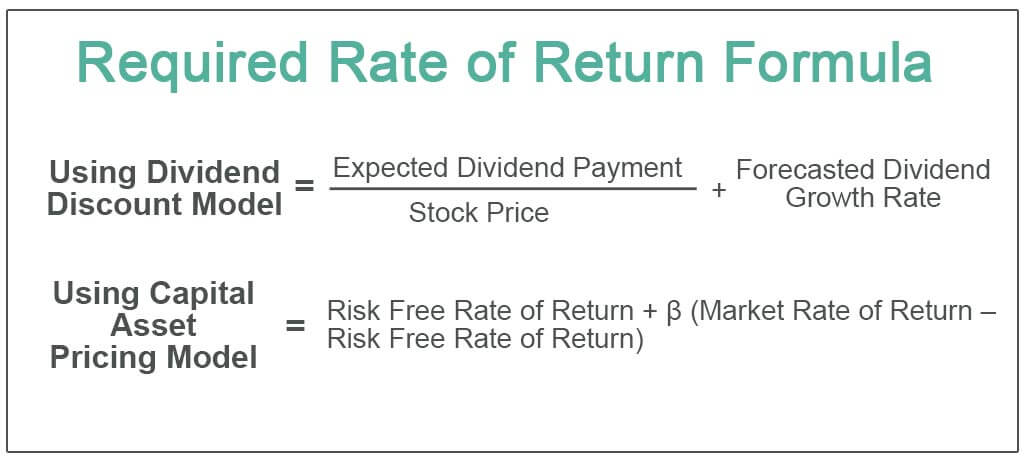

Required Rate Of Return Formula Step By Step Calculation

/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Internal Rate Of Return Formula Definition Investinganswers

:max_bytes(150000):strip_icc()/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)

Expected Return Definition

Expected Return Formula Calculate Portfolio Expected Return Example

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Rate Of Return Definition Formula How To Calculate

Expected Return Er Of A Portfolio Calculation Finance Strategists

Discount Rate Formula How To Calculate Discount Rate With Examples

Rate Of Return Formula What Is Rate Of Return Formula Examples

Real Rate Of Return Definition Formula How To Calculate

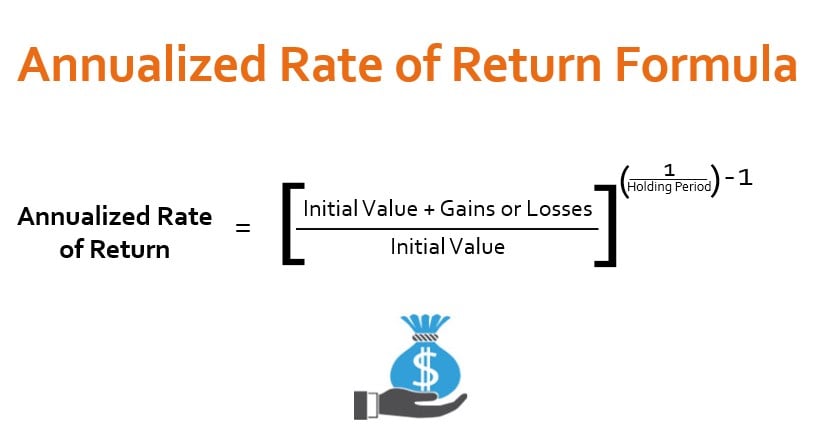

Annualized Rate Of Return Formula Calculator Example Excel Template